Wisconsin is a wonderful location to feel a first-date domestic visitors using its gorgeous surface, enduring places and https://cashadvancecompass.com/loans/loans-for-400-credit-score/ you may solid housing market. To find a house will likely be enjoyable but daunting specifically for earliest day consumers. This guide have a tendency to take you step-by-step through our home to purchase processes in the Wisconsin covering topics such lowest credit rating standards, commission assistance apps as well as other home mortgage choices.

Starting out

Because the an initial-big date domestic buyer in the Wisconsin, you will find many information and you can software to create the dream about homeownership an actuality. The newest Wisconsin Housing and you will Economic Creativity Expert (WHEDA) has the benefit of of several loan applications and you may percentage guidance choices to provide come. WHEDA’s downpayment assistance software give next mortgage loans to fund deposit, settlement costs, and/or prepaids. Knowing these info could make buying your first house within the Wisconsin so much easier.

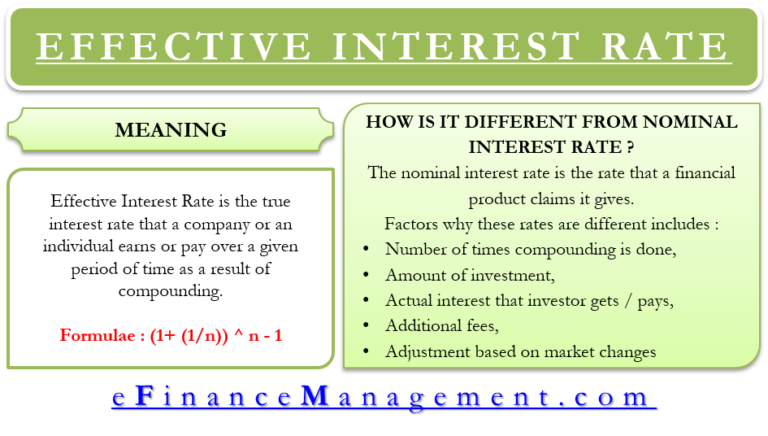

More financing applications have other credit history conditions and understanding in which you stay will allow you to select the right mortgage. Fundamentally, increased credit score will qualify your for better interest levels and you will mortgage conditions that is essential first-time homebuyers in the Wisconsin.

Payment Advice Programs: Commission assistance apps are necessary for the majority basic-day customers. Wisconsin has several apps to support down costs and closing can cost you in order to manage the first house. These types of programs also provide features, low interest financing otherwise forgivable funds to assist connection the fresh economic gap.

Financial Creativity: The Wisconsin Construction and Financial Development Power (WHEDA) was a button player in assisting first-time homebuyers by way of loan apps and you can financial assistance selection. WHEDA’s purpose is always to bring affordable housing and you can economic growth very its a great resource to possess first-time people from inside the Wisconsin.

Version of Financing

FHA Financing: New Federal Construction Government (FHA) financing was a popular one of first-time homebuyers in Wisconsin. FHA finance provides lower down percentage criteria and are usually a lot more easy having credit score standards therefore more buyers normally qualify. Such loans are insured from the FHA and so the chance is actually all the way down towards the lender, and they could offer most readily useful words into borrower.

Conventional Loan: Conventional money are an alternative choice getting Wisconsin people. This type of money need a high credit score but give significantly more liberty having loan number and words. Antique loans will be fixed rate or changeable speed, so you have options to match your financial situation and you may goals.

USDA Funds: If you are searching to purchase just one-home for the a rural city, USDA finance give no advance payment and you can competitive rates. Such money is supported by this new U.S. Service out of Agriculture and tend to be designed to give outlying advancement. Wisconsin has some section one to qualify for USDA loans, making this good option for those in search of good rural lifestyle.

Va Financing: Qualified pros can use Virtual assistant finance which have finest terms and you may tend to zero personal home loan insurance. Such fund try guaranteed from the U.S. Institution regarding Veterans Items as they are to assist pros achieve homeownership. Wisconsin keeps a huge seasoned populace and you may Virtual assistant finance was a great significant advantage when you have served.

WHEDA Mortgage: WHEDA fund was for Wisconsin residents merely and offer aggressive prices and you can commission recommendations. Such loans can handle first-time homebuyers from inside the Wisconsin so that you have the assistance and you can information to help you with each other the way in which.

Financials

Downpayment: One of the biggest barriers to possess first time buyers is the deposit. Wisconsin has numerous advance payment guidelines software to help eligible borrowers see it demands. Software particularly WHEDA Investment Availableness DPA render financial assistance to minimize the fresh upfront will set you back of shopping for a house.