Highlights:

When it comes to unsecured monetary devices for instance the consumer loan, common guidance always spins as much as principles to own credit rates-effectively. Resources are recommendations for example, look for a low fees’, opt for the lowest yearly interest (AIR)’ or see what is Apr and you can determine apr (APR) beforehand’. While you are speaking of useful, when you’re not used to credit, you may find yourself curious:

- What’s the annual interest rate?

- What’s the apr?

Quite simply, Sky ‘s the annual interest rate relevant towards mortgage. In case Heavens ‘s the interest next:

- What is Annual percentage rate and exactly why would it be crucial?

- How does Apr works?

- What is good annual percentage rate?

Speaking of extremely important issues you must seek answers to once you need certainly to obtain optimally. In fact, it’s also advisable to take the time to can estimate Apr. To make sure you are well-equipped so you’re able to use optimally, let me reveal everything you need to find out about brand new apr meaning, tips determine apr and exactly how it really works.

What does Annual percentage rate Imply?

Apr was a percentage one indicates the full yearly price of the mortgage by the considering the yearly interest rate being offered and you may almost every other various fees.

Precisely what does Annual percentage rate represent? The brand new Annual percentage rate definition from inside the financial are Annual percentage rate. Annual percentage rate is sold with any costs your own lender could possibly get levy, instance processing charges, management charges, insurance costs, while some. Than the Sky, it gives a far more specific profile of total annual cost of financing.

You will need to note that there’s two brand of APR: representative and private. Associate Annual percentage rate lies in the fresh claimed yearly interest rate into the the loan. Individual Annual percentage rate will be based upon the fresh annual interest offered to you of the financial considering the qualification and you will financial reputation. It’s important to note that the non-public Annual percentage rate is generally higher than this new representative Apr, which means what you get utilizes debt background.

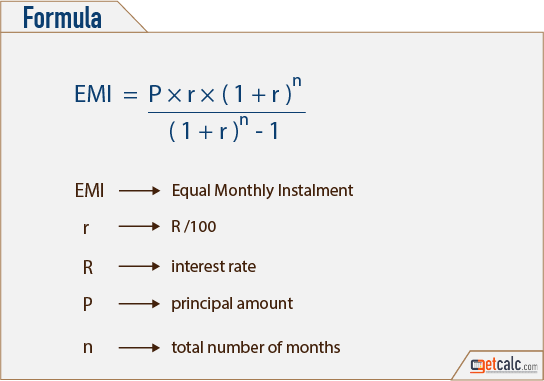

How does Apr Really works and ways to Assess Apr?

The fresh new Apr out-of that loan is the yearly price of the brand new loan expressed given that a percentage. It gives the speed or any other miscellaneous costs away from choosing the mortgage. This provides you the genuine cost of credit a-year, and is particularly important once the loan providers get lure your which have a reasonable Heavens however, levy significant even more charge. Thus, it is very important estimate the latest Annual percentage rate before you could use very that you’re aware of the actual appeal outgo that have any given instrument.

Why do You must know the brand new Apr?

While the the Annual percentage rate clearly shows the actual price of a financing, their no. 1 goal will be to help you examine individuals mortgage offerings ideal. america cash loans Frisco City Although not, it is vital to note that Annual percentage rate will not take into account compounding and you can isn’t really energetic having floating interest rate money.

Which is said, knowing the Apr helps you compare loans for more than simply their total price. If your Annual percentage rate into that loan with better advantages are a bit higher, you’re in a better position to help you consider the cost of these pros than just you will be for many who only judged built to the stated yearly interest rate.

What exactly is a great Apr?

If at all possible, you are searching for a providing with a good harmony between a reasonable Annual percentage rate and you may mortgage enjoys. What is a great Annual percentage rate perform are very different for several some body and you may to track down they, you will have to calculate the brand new member Annual percentage rate for a couple viable offerings. In that way, you can identify the common and pick tool that rest less than it.

Your it, understanding the difference between the new annual rate of interest plus the Annual percentage rate is actually what’ll make it easier to obtain wisely. For that reason understanding how to estimate Annual percentage rate is an important skill to possess whilst facilitate account for the cost. Whenever scouting to own offerings on the market, it guarantees a real assessment, according to research by the total price by yourself. This is where there are choice for instance the Bajaj Finserv Private Financing get noticed amongst the anybody else because it features an affordable Apr and has multiple well worth-added financing benefits as well!

Here, you should buy approved to own a personal loan as much as Rs.twenty five lakh offered at an appealing rate of interest and you may affordable charges. You could go for a flexible tenor you to selections up to sixty weeks to store payment comfy. Other advantages become small financing control, same-go out disbursal, a low requirement for documentation, and you can digital provisions to possess financing management. Locate investment into the a totally dilemma-totally free manner, look at the pre-recognized promote!