Taking pre-recognized to suit your home loan is a huge initial step. It’s fundamentally telling you as you are able to manage a home. Its an atomic bomb on your own collection and you may allows suppliers and you can agents know that you will be major. Yet not, it is not the conclusion debt files, and you may does not mean you have everything you secure. You can still find a number of difficulties to conquer. Listed here are 8 what to keep in mind for the reason that months anywhere between pre-approval and you can finalizing the very last data files

Keep your Automobile If you don’t Relocate

The following is a phrase you will hear Much during the this informative article. DEBT-TO-Earnings Ratio. This might be one of the most techniques to keep during the attention within the entire process off applying for your house. Make sure that you you should never increase the amount of obligations as to what you have, or it trigger red flags in the techniques. We shall work at your borrowing from the bank using your software, however, we will and additionally consider once again ahead of i settle, with the intention that nothing radical has took place. If you buy a different auto and put a great amount of obligations for you personally, it will skew your own borrowing and you will push me to need certainly to to improve the loan. Hold back until after you sign on the dotted range, guys.

Usually do not Start You to definitely The brand new Work Yet ,

Something that financial companies eg you prefer to pick try Stability. We should be aware that youre set in your task and aren’t planning move, while the we require one pay back your own home loan. Confidence on your own standing is a significant cause of your own home loan, of course your suddenly key jobs, otherwise start an alternate company, your own financial support affairs alter, and we need certainly to readjust your application to match it. This can end in your own rates to switch because the confidence in your capability to repay your loan get disappear.

Continue You to Constant Salary

This is exactly a comparable reasoning. Although you will earn more money straight away, a new, heavily-commissioned occupations frightens financial organizations. Supposed of an ensured salary to 1 where you could create significantly other wide variety monthly are a play, and not the one that home loan organizations like to rating sprung into the all of them after they’ve got already viewed your steady paycheck.

Let your Currency Settle

Let your money settle. Banks and you may financial companies do not like observe your finances getting around if we accept you to own a home loan. It does not promote believe observe thousands of dollars gone around. The lending company will additionally either be sure your cash reserves to ensure that one may afford the settlement costs on the mortgage so keep currency where its.

Keep the Expenses Latest

Even though you is actually disputing a costs, shell out it if it’s planning be a later part of the payment or other struck facing your borrowing from the bank. Speaking of credit poison, and we’ll see them as soon as we perform our very own take a look at till the finally acceptance of the home loan. Your mortgage try a continuously changing amount that have to be tracked. Don’t allow a bad bill help keep you from the fantasy household!

We obtain it. You are getting into your brand new household while wish to have everything prepared to move in. Cannot exercise! Regardless of if you will get an informed contract ever before by the filling in credit cards to buy your seats and devices, a lot more obligations is more personal debt! You really need to maintain your Obligations so you’re able to Income Ratio just like the lowest as you are able to regarding the app procedure. If this changes substantially we should instead reassess your credit score and it will connect with one last app.

Submit Your Gift Documentation

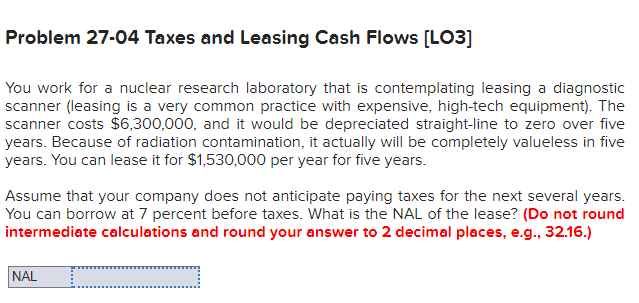

Of numerous moms and dads provide a present to their youngsters and work out their earliest downpayment on their land. However, this really is a secured item that might be logged and taxed securely. You will find different laws based on how the off costs for every sort of mortgage can be utilized.

Traditional

- For many who lay out 20% or even more, it does all be out-of a gift.

- For people who put down below 20%, part of the currency is going to be something special, however, area need to come from your own loans. That it minimal contribution may differ by the financing variety of.

FHA and you can Va

In the event your credit rating is anywhere between 580 and 619, no less than step 3.5% of the down payment must be the money.

You also will need the latest gifter to transmit something special Letter a page explaining that this cash is a present and not that loan. You really need to have them to is:

- The brand new donor’s name, address and you can contact number

- Brand new donor’s link to the customer

- The brand new dollar level of the fresh new present

- The newest day the amount of money was basically transferred

- A statement throughout the donor one to zero cost is anticipated

- The donor’s signature

- New target loans Brewton AL of the property are ordered

Home loan businesses wish to know where your finances comes from, so that they determine if you have people expenses that will maybe not appear on your credit report.

Keep Documentation For all the Dumps

Should you choose get any money you need to ensure that that it’s noted very carefully. For individuals who sell your car, found a genetics, or win brand new lottery, that is great! Yet not, it ought to be documented properly. For folks who sell an automobile, you need no less than the fresh new statement out of purchases. Getting the advertising you accustomed sell in addition to Kelly Bluish Guide to show the importance don’t damage, often. For people who received a payment off an old personal debt, this new terminated consider tends to be adequate, or a page from the payer may be required. In the event your business doesn’t do lead deposit, anticipate to show glance at stubs to suit your paychecks. What makes so it important? Because your lender wants to see for sure just what that money try. In case it is that loan, they’ll read. You need to be sincere, once the covering up that loan from your own bank try con.