A house equity financing are a popular means to fix borrow money to possess property update investment, to help you consolidate financial obligation, or pay unforeseen expenditures, including. It may be also you can easily to make use of a property collateral financing to invest in another family.

Because these funds is actually recognized on equity of your property, they’ve lower rates than other credit selection. They could be also acquired apparently quickly. With respect to the bank, just how long it entails to acquire property security mortgage could possibly get end up being step one-six days.

Before applying to possess a home guarantee loan, it is vital to comprehend the effect one to settlement costs have some bucks out of borrowing from the bank. You will find several implies, however, that you could often reduce otherwise cure this debts.

Insurance

Certain kinds of insurance policies may be needed to qualify for a house equity mortgage. They might include name insurance rates, home insurance, flood insurance policies, although some.

Local Taxation

A community bodies get evaluate an income tax on your own household equity loan. According to where you live, brand new income tax ount.

Label Lookup

A subject lookup may be needed to ensure no one has one claims or liens on the domestic. This is certainly necessary because the equity you’ve got in your home is used given that security. The new label lookup percentage might be $100-$450.

Points

An excellent “point” is actually a charge as you are able to pay upfront to reduce the interest. Buying items is actually elective, and every area commonly lower your interest by the a-quarter of a %. For each area will cost 1% of your total level of your loan.

How-to Reduce your Home Guarantee Financing Settlement costs

Although many loan providers charges settlement costs to their household collateral finance, there are some tips you can utilize to save money on the these fees. You’ll be able to have the ability to beat some otherwise all of all of them.

Pay back Most recent Expense

In relation to you getting property security financing, loan providers will take a look at your current costs to make sure you are not overextended. If the more than 43% of the disgusting monthly earnings is utilized to spend their month-to-month expense, settling several of the money you owe before you apply may give your significantly more options for paying the closing costs.

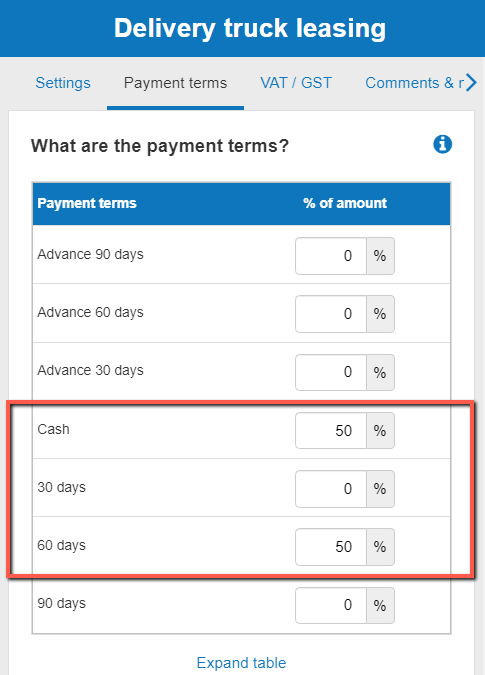

You’re considering the choice to finance this new settlement costs, particularly, by adding these to the primary. This should help you stop needing to developed the fresh new currency upfront.

Contrast Other Lenders’ Finance

Not totally all loan providers have the same settlement costs and/or same rates of interest payday loan Lake Bungee. So before you apply having a home collateral loan, be sure to examine various other lenders’ loan terms and conditions, interest levels, and settlement costs. This can help you get the best price to spend less.

Definitely Negotiate

Particular settlement costs is generally negotiable. A lender ple, if you’re a long-label customers. Make sure to enquire about this new fees to find out if your bank often imagine waiving a number of them. You will never see unless you ask.

Only Borrow What you need

Whenever making an application for a property guarantee mortgage, you’re inclined to acquire more you would like. You are able to borrow even more to invest in something that you wanted, to have some more cash on hand, and for another reason. Credit more you need, not, could result in higher settlement costs.

The latest closing costs for family equity money are typically 2-5% of your amount borrowed. The more you use, the better the newest charge was.

Come across a loan provider That gives House Equity Loans Versus Settlement costs

Even the best way to save money to the household equity loan settlement costs would be to just favor a lender that doesn’t fees people, like Deeper Colorado Borrowing Connection. According to the number youre credit, the new deals is tall.

House Equity Money That have Better Tx Credit Connection

If you’re considering borrowing resistant to the equity of your property, Greater Colorado Credit Union has the benefit of a home guarantee loan having a good aggressive rate of interest. Our house collateral financing also has no people closing costs, which can help you save currency.

The applying techniques is easy and quick. For those who have any queries, you can get in touch with one of our Mortgage Agency agents by the mobile or by the on the web content to possess guidelines.